Introduction

Banking is described as "accepting for lending and investing public deposits of money repayable on demand order or otherwise and withdrawable by check, draught, or otherwise." Banks help economic development by mobilizing tiny and dispersed community savings and disbursing them as loans to businesses. Banks thus provide the functions of credit intermediation, netting, and payment settlement. The banking system's primary functions are to mobilize public resources and redirect them into growth-oriented activities. The better the financial intermediation, the more developed the banking system. The banking system, with its extensive network, is the most effective at collecting public savings and allocating them to productive activity.

The banking system in India came into effect in the mid 18th century. Banks are the institutions that help for the smooth functioning of economical (monetary-related) activities. The banking system is divided into two categories: cooperative banks and commercial banks, with commercial banks accounting for more than 90% of the banking sector's assets. From there another classification can be observed in Commercial banking system which are further classified into three types based on their ownership structure: a) state-owned or public-sector banks, b) private banks under Indian ownership, and c) foreign banks operating in India.

Cooperative Banking has grown as an important component of the country's financial system, reaching even the most rural parts of the country. A cooperative bank is an institution made up of a group of people who come together to combine their surplus savings to eliminate the profits of bankers or money lenders and distribute them to depositors and borrowers. Though cooperative banks differ greatly in structure, both within and between nations, they always have a broader and more democratic type of ownership. They are governed by members, who each have one vote, rather than shareholders, whose votes are proportional to their financial stake.

Public sector banks are known for having a better organizational structure and a larger customer base penetration. When opposed to privately-owned banks, the work climate is also less competitive, and professionals are typically not required to focus on hitting targets and being the best performance in a team. In India, public sector banking began in 1955 with the nationalization of the then-Imperial Bank as the State Bank of India. One of the defining occasions in the Indian banking system was the nationalization of 14 private sector commercial banks in 1969.

The primary duty of any of the both public or private sector bank is to mobilize the resources and capital amassed via various deposits and schemes for varying periods and lend them to its customers at higher rates of interest to maximize profit from the money.

Cooperative banks vs. Public sector banks

The major difference between cooperative banks and public sector banks is that cooperative banks which are founded on a cooperative basis are an association of people who come together voluntarily to provide banking solutions. A cooperative bank is typically established to address a common economic, social, or cultural need. Cooperative banks offer high-interest rates on deposits while offering low-interest rates on loans, and they also encourage borrowing to limit the risk of loss. Farmers in rural areas have benefited greatly from these agricultural bank programs, which enabled them to purchase farm-related commodities such as seeds and fertilizer. At the same time, loan interest rates are slightly lower in Public Sector Banks, such as SBI. Fees and costs, such as those associated with balance management, are cheaper in public sector banks.

Public sector banks are those owned by the government and have more than 50% of their stock in their own hands. Cooperative banks assist small businesses and individuals. The majority of depositors believe that public sector banks are safer than private ones because they are owned by the government. This has resulted in the majority of public sector banks having a significant customer base.

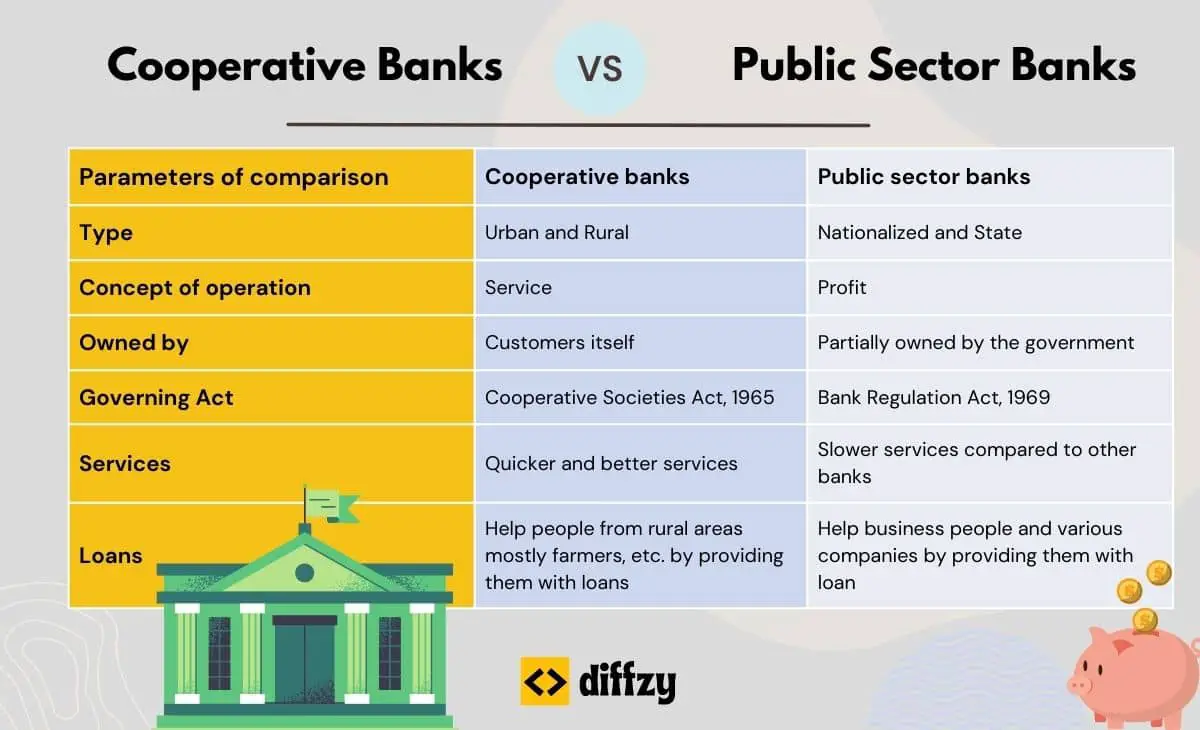

Difference between Cooperative banks and Public sector banks in tabular form

| Parameters of comparison | Cooperative banks | Public sector banks |

| Type | Urban and Rural | Nationalized and State |

| Concept of operation | Service | Profit |

| Owned by | Customers itself | Partially owned by the government |

| Governing Act | Cooperative Societies Act,1965 | Bank Regulation Act, 1969 |

| Services | Quicker and better services | Slower services compared to other banks |

| Loans | Help people from rural areas mostly farmers, etc. by providing them with loans | Help business people and various companies by providing them with loan |

What are Cooperative Banks?

Cooperative banks play an essential role in a variety of financial systems. When seen as a group, they are among the greatest financial institutions in a lot of countries. Furthermore, the proportion of cooperative banks has grown in recent years. The law regulating these banks is enforced by the state governments. Short-term loans are made to agriculture and other related industries through these banks. Cooperative Banks are operated under Cooperative Societies Act. Through providing low-interest loans, Cooperative Banks are primarily responsible for enhancing social welfare.

Cooperative Banks are organized in a three-tiered framework in India;

First tier: Primary Agricultural Financing Societies (PACS) work at the grassroots level, dealing directly with farmers to meet their immediate and medium-term credit needs. They encourage agriculturalists to save and provide loans to poor farmers.

They raise funds through share capital, membership fees, deposits from members and non-members, and loans from Central Co-operative Banks and the government.

Second tier: Central Co-operative Banks (CCBs) are located in the middle of the three-tiered system. They operate at the district level and serve as a link between the PACs at the base level and the money market. Their primary purpose is to make loans to PACS. They also provide loans to others and offer remittance services. They transfer surplus funds from surplus primary societies to deficit primary societies.

They primarily obtain working capital from deposits and borrowings. Individuals and co-operative societies make the majority of deposits.

Third tier: State Co-operative Banks (SCBs): are the state's apex banks. They provide loans to CCBs for them to lend to PACS. They serve as a conduit for the RBI to extend loans to cooperatives. They manage and control the CCBs and, through them, the PACs because they finance them. They serve as the state's cooperative movement's leader.

Their funds are raised by share capital, public deposits, and loans from state and commercial banks. The Reserve Bank of India contributes 50 to 90 percent of its working capital.

Apart from all of these Cooperative banks operate under the basic rule of "one member, one vote." Co-operative banks are more democratic than commercial banks since they provide all of the core functions that a commercial bank does. Cooperative banks are organized on a federal level. Co-operative banks function as an intermediary for their customers, accepting cheques and draughts from them and lending money to other co-operative societies and banks at a lower interest rate.

Aside from all of the above-mentioned benefits provided by Cooperative Banks, there are some drawbacks too. Cooperative Banks require investors to lend them money, which can be difficult to find at times, and the number of past-due accounts has been continuously increasing over time. Rich landowners have reaped the benefits of cooperative banks in rural areas, rather than small industrialists who want financial assistance.

What are Public Sector Banks?

Public Sector Banks come under the commercial banking system. PSBs or the Public Sector Banks are the most important source of financial savings mobilization. The government retains the majority of the stock in such banks. Public Sector Banks include the Punjab National Bank, the State Bank of India, and the Central Bank of India, among others. A key role played by public sector banks (PSBs) in the Indian economy is crucial. Several large projects have recently been slowed down due to a number of legacy challenges, such as delays in clearance processes as well as land acquisition, and also because international and domestic demand is weak. This issue has had an impact on public sector banks, which have a disproportionate share of infrastructure finance. It has led to poorer profitability for public sector banks, owing mostly to provisioning for restructured projects and gross NPAs.

Since the nationalization of the State Bank of India in 1955, followed by the nationalization of other banks in 1969 and 1980, PSBs have constituted the backbone of Indian financial architecture. Despite challenging global conditions and turmoil in the Indian economy, PSBs have met their mandate with the help of the government and the RBI.

The focus of public sector banks is not necessarily profit, but they also consider the development of the region in which they operate.

Even though there are various advantages there are a few disadvantages too for Public Sector Banks. In terms of financial results, it trails. When most metrics, such as nonperforming assets (NPA) and net interest margins, are examined, private sector banks appear to outperform public sector banks. Some public sector banks have also suffered losses in recent years.

Main differences Between Public Sector Banks and Cooperative Banks (In Points)

- Cooperative Banks aid in the upliftment of poor sections, whilst Public Sector Banks are more profit-driven.

- While Cooperative Banks are owned by their customers, we can see that Public Sector Banks are mostly owned by the government only.

- Cooperative banks are slightly less transparent than public sector banks, which must answer to the government.

- Public sector banks serve the general public throughout the country, although cooperative banks service the general public in rural areas.

- Cooperative Banks works on Cooperative Societies Act, 1965 and Public Sector Banks works on Banking Regulation Act, 1949

- The basic objective of a cooperative bank is to take deposits from members and the general public and to make loans to farmers and small business owners. Contracts with Public Sector Banks whose principal duty is to receive public deposits and make loans to individuals and businesses.

- Cooperative Banks have a comparatively higher rate of interest on deposits and relatively less array of services, whilst Public Sector Banks have less rate of interest on deposits and offer an array of services.

- The area of operation of the Cooperative banks is somewhat smaller when compared to the Public Sector Banks which have a large area of operation.

Conclusion

To summarize, banking is crucial for economic growth and development. In India, public sector banks (PSBs) have been at the vanguard of mobilizing resources from remote rural areas and extending banking services to the most remote sections of the country. PSBs have borne a disproportionate share of the weight of the social agenda with no remuneration. Banks are particularly vulnerable to corruption and wrongdoing since they deal with the most liquid assets. The surge in cases of fraud resulting in NPAs in the banking sector is also fueling growing worry about escalating corruption in the financial sector.

Computerization and development in Information Technology have influenced banking just like every other field. Virtual Banking is also very common these days. Electronic Banking, Mobile Banking, Online Banking, POS, ATM, and CDM are some of the notable changes that occurred in the Commercial Banking scenario.

Despite the fact that cooperative banks were created to aid one another, they lack transparency and services. The RBI must ensure that cooperative banks are conducted transparently and honestly to assist in the upliftment of the poor. Typically, wealthy landowners reap all of the benefits provided by cooperative banks, which is unjust.

Since public sector banks are owned by the government, the government frequently injects new money into them, allowing them to flourish. People come from all across the country to use these banks for loans or to store their money in the lockers. Public Sector Banks also provide a variety of programs to assist their consumers, and their fees are typically lower than those charged by Private Sector Banks such as ICICI or HDFC. However, their performance and services are slow and of poor quality.

Before choosing a bank, make sure you understand everything about it. It should be skilled enough to gain the trust of a consumer, regardless of industry.

References

- http://www.drbrambedkarcollege.ac.in/sites/default/files/AN%20INTRODUCTION%20TO%20INDIAN%20BANKING%20SYSTEM.pdf

- https://www.researchgate.net/publication/349663870_Performance_of_Cooperative_Banks_in_India_An_Overview

- https://www.iimb.ac.in/sites/default/files/2018-07/WP%20No.%20530.pdf

- http://164.100.47.193/Refinput/New_Reference_Notes/English/Non-Performing.pdf